"Leaky Roof? Get It Fixed Fast – Book a Free Inspection Today!"

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Are you tired of hearing that [Common Belief] is the only way to achieve [Desired Result]? What if we told you there’s a faster, simpler way to get the results you want, without the stress and hassle of [Common Belief]?

Licensed & Insured Roofing Experts

Lifetime Warranty on Materials

Fast, Free, No-Obligation Inspections

Certified Roofing Company

Public Adjusters for

Commercial & Multifamily Hurricane Claims

Maximize Your Settlement.

Minimize Delays. Protect Your Property.

No Recovery, No Fee for Claims Over $250K

Licensed Insurance Policyholder Advocates

500+ Satisfied Policyholders and Counting

Non-Litigious Solutions

Over $250,000,000 Recovered

INSURANCE COMPANIES HAVE EXPERTS WORKING FOR THEM. YOU SHOULD, TOO!™

We help Commercial, Multifamily, Industrial & Religious Properties get the hurricane settlement you deserve!

Hurricane Damage?

Get Expert Help Navigating Your Property Damage Insurance Claims

Maximize Your Settlement. Minimize Delays. Protect Your Property.

Storm damage doesn’t end when the skies clear—it’s just the beginning of the battle with your insurance company. As licensed public adjusters, we advocate exclusively for commercial and multifamily property policyholders recover what you deserve fairly and promptly.

Fast, Free, No-Obligation Inspections. We’ll Be in Touch Within 24 Hours!

No Recovery, No Fee Representation for Claims Over $250K

20+

Years Of Experience

500+

Large-Loss Claims Settled

130,160

Hours Worked

$450,000

Average Claim Amount

Apartment & Multifamily Hurricane Damage Claims

Commercial Building

Hurricane Damage Claims

Luxury Home

Hurricane Damage Claims

Hurricane Claim Advocates For Policyholders

We Exclusively Represent Policyholders

No Recovery, No Fee Representation*

We don’t get paid unless you do.

Proven Results

Successfully settled hundreds of millions in property damage claims.

Expert Representation

500+ large-loss claims settled fairly & promptly.

Avoid Unnecessary Litigation

We maximize settlements without unnecessary legal battles.

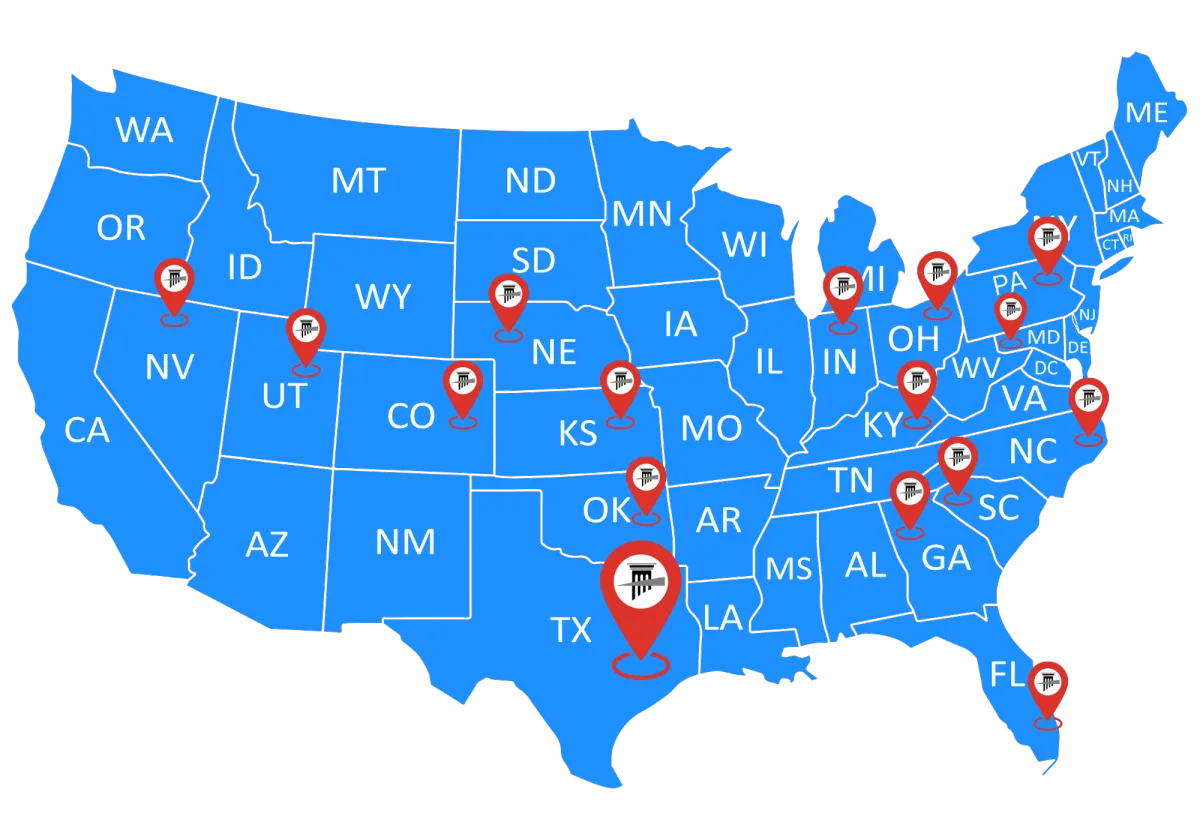

Licensed Public Adjusters Nationwide

We work exclusively for policyholders, not insurers.

Verifiable Success

Increased settlements over initial offers by 20% to 3,830%+

Why You Need a Public Adjuster for Hurricane Damage

Every hurricane season brings billions in insured losses—but many policyholders are left shortchanged due to:

Misclassified damage (e.g., wind-driven rain vs. flooding)

High Named Storm Deductibles

Denied or underpaid claims from insurance company adjusters

Missed coverage due to unclear policy language

ICRS levels the playing field. We represent YOU—not your insurer.

Common Hurricane Damages

We Help Identify & Claim

1. High Wind Damage

Torn, uplifted, or punctured roofing

Detached rooftop mechanical equipment (HVAC, antennas, solar panels)

Cracked walls, parapets, or shifted structural framing

Broken windows, doors, and seal failures

2. Wind-Driven Rain & Moisture Intrusion

Rain forced into walls, roofs, or vents

Moisture-wicked insulation, soaked drywall, or carpet

Mold and mildew from delayed dry-out

Electrical corrosion or shorting

3. Storm Surge & Flooding

Water damage to electrical/mechanical rooms in basements or parking garages

Foundation weakening or soil erosion

Saltwater and sewage infiltration into systems or drywall

4. Business Interruption

Tenant displacement and loss of rental income

Construction delays affecting lease compliance

Downtime in operations or delayed move-ins

What the Last 3 Hurricane Seasons Taught Us

Hurricane Ian (2022): >$60B in damages; insurers denied claims due to “flooding exclusions.”

Hurricane Idalia (2023): Carriers invoked Named Storm Deductibles, minimizing payouts.

Hurricane Nicholas (2021): Thousands of roofs damaged from winds but under-assessed.

These trends show increasing complexity—and resistance—from insurers. You need a licensed public adjuster to protect your rights.

The Critical Role of Water Mitigation

Failure to properly mitigate = denied or reduced claim.

Don’t Let Hidden Moisture Sabotage Your Recovery:

If not mitigated within 24–48 hours:

Mold can spread

Structural wood may rot or warp

Electrical damage can become severe

Insurers may deny the claim for “failure to prevent further loss”

How to Qualify

Water Mitigation Contractors:

Failure to properly mitigate = denied or reduced claim.

Don’t Let Hidden Moisture Sabotage Your Recovery:

If not mitigated within 24–48 hours:

Mold can spread

Structural wood may rot or warp

Electrical damage can become severe

Insurers may deny the claim for “failure to prevent further loss”

Know Your Policy:

Key Hurricane Claim Pitfalls

Named Storm Deductibles

These are often 2–5% of the insured value, not the claim amount. For a $10M building, a 5% deductible equals $500,000 out-of-pocket.

Wind vs. Water Language

Insurers often deny or split wind vs. water-related damages. Public adjusters ensure accurate causation is documented.

Duties After a Loss

Most policies require you to:

Promptly report the claim

Prevent further damage

Submit detailed proof of loss

Failure to comply may void coverage.

Educational Resource: Hurricane Aftermath Guide

What ICRS Public Adjusters Do for You

Benefit What You Get

Damage Documentation Detailed reports with experts (roofers, engineers, contractors)

Policy Interpretation Clarity on Named Storm Deductibles, coverage gaps, and fine print

Claim Preparation Organized, substantiated claims including valuations & business loss

Direct Negotiation Skilled representation with your carrier throughout the process

Large-Loss Consultation

No Recovery, No Fee Representation on claims over $250K

ClaimNavigator™

Flat-fee consulting

for claims under $250K

Who We Serve

Apartment Owners & Multifamily Operators

Churches & Religious Organizations

Commercial Property Owners & Managers

Real Estate Investors, Syndicators & REITs

HOAs

Educational, and Municipal Institutions

Struggling With?

Initial Hurricane Claims

Whether you're filing an insurance claim for a commercial building, an apartment complex, or a luxury home, filing it correctly from the outset is crucial.

Large-loss hurricane claims involve significant property damage and high-dollar settlements. As one of the Nation's most trusted public adjusters, we make sure your initial claim is accurately documented, aggressively represented, and positioned for maximum settlement in minimum time.

Underpaid

Hurricane Claims

Insurance companies often lowball hurricane claim payouts especially on large-loss properties. If your settlement doesn’t match the real scope of damage, you could be leaving thousands on the table.

At ICRS our experts identify missed damage, undervalued estimates, and hidden policy coverage gaps. We reopen, negotiate, and supplement

underpaid claims to recover what you’re truly owed.

Delayed or Denied Hurricane Claims

Denied hurricane claim? You’re not alone. Insurers often cite

policy exclusions, pre-existing damage, or missing documentation to avoid paying.

Our public adjusters specialize in

overturning wrongfully denied hurricane claims - correcting inspection errors, providing new documentation, and demanding fair treatment.

Licensed Public Adjusters In 16 States:

The Nations Leading Hurricane Damage Claim Specialists

Hurricane Claim Just Starting, Denied, or Underpaid?

Whether your hurricane claim has just started or been delayed, denied, or lowballed, it’s time to take action.

Insurance carriers often dispute hurricane damage claims, but we have the expertise to accurately assess the real extent of your losses.

Schedule a claim consult today.

Don’t Go It Alone Against the Insurance Giants

Insurance companies have teams of adjusters, engineers, and attorneys.

You deserve an expert on your side.

35 + Successful Projects

Local Roofing Experts

100% Guarantee

The Nations Leading Hurricane Damage Claim Specialists

Hurricane Claim Just Starting, Denied, or Underpaid?

Whether your hurricane claim has just started or been delayed, denied, or lowballed, it’s time to take action.

Insurance carriers often dispute hurricane damage claims, but we have the expertise to accurately assess the real extent of your losses.

Storm and wind damage

Schedule a claim consult today.

Don’t Go It Alone Against the Insurance Giants

Insurance companies have teams of adjusters, engineers, and attorneys.

You need an expert on your side.

Why Choose ICRS TESTIMONIALS

Hear what Our Clients are saying

"Thank you Scott"

Scott responded to my inquiry and took the time to listen and understand our unpleasant experience dealing with our insurance claim. Although I did not utilized his service, he gave me a sound, professional advice and offered to help when he referred me to his engineer. They replied promptly and I was able to have better understanding of the situation. Thank you Scott!

- Haidee J.

"I would highly reccomend"

Words can’t describe how grateful we are for the consultation and claim evaluation we had with Scott. Full disclosure we were unable to work with him due to limitations of our scope. We wanted to properly recognize Scott for the honest and genuine passion he put in to not only our claim, but the way he runs his business in general. We hadn’t had such clarity of next steps since this began in 2020. I would highly recommend this business to everyone spinning their wheels in this process!

- James M.

"I came across this company and had none of those bad feelings"

This was not the first public adjuster I called. I called a different company first but they gave me a bad feeling on the phone. Too aggressive. Didn't feel trustworthy to me. So, I kept looking. I came across this company and I had none of those bad feelings. Scott, the guy who took my call, seemed very knowledgeable and I felt I could fully trust him. As it turned out, he told me that my claim was fairly simple and I didn't need the full scope of his service and fees. But, without charging me a fee, he gave me some needed advice on this whole matter of insurance claims which I needed. And told me I could call him back to ask another question or two if necessary. I would recommend this company for these services.

- Katie H.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

ATTENTION: TARGET AUDIENCE

How To Desire Without Doing Z To Achieve Goal

Download the free report and take your marketing to the next level

Unsure If you need a public adjuster?

Frequently Asked Questions

What qualifies as hurricane damage under my commercial policy?

Hurricane damage may include wind damage, wind-driven rain, and storm surge. However, how each peril is covered depends on your policy language.

What is a Named Storm Deductible and how does it affect my claim?

It’s a special deductible applied to named storms (e.g., Ian, Idalia), typically 2–5% of your building’s insured value. It can drastically reduce the net claim payout if misunderstood.

What’s the difference between flood damage and wind-driven rain?

Flood is typically rising water from the ground up (covered under separate policies), while wind-driven rain enters through a storm-damaged envelope (usually covered under the standard property policy).

Why would my insurance company delay or underpay my hurricane claim?

Insurers may:

• Dispute causation (wind vs. flood)

• Misapply deductibles

• Demand unreasonable proof of loss

• Use internal estimators to undervalue repairs

What if I already started cleanup? Will it affect my claim?

It could. If cleanup isn’t properly documented or overdone, it may remove evidence needed to prove your loss. Contact a public adjuster before demo or repairs.

How soon should I report a claim?

Immediately. Delays can violate your policy’s “notice of loss” clause and create grounds for denial.

What are “duties after a loss”?

These are contractual obligations, such as protecting the property, cooperating with inspections, submitting a proof of loss, and keeping records.

How do I choose the right public adjuster?

Look for:

• State licensure

• Experience in commercial/multifamily hurricane claims

• References or case studies

• Clear fee structures (e.g., contingency or flat-rate)

Can I still hire a public adjuster if my claim was already filed?

Yes. A public adjuster can help supplement, re-open, or negotiate an existing or underpaid claim.

What is ClaimNavigator™?

It’s our flat-fee consulting service for smaller claims (under $250K). You get expert guidance without the full contingency model.

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

AGENCY PUBLIC ADJUSTER LICENSES

MISTY'S PUBLIC

ADJUSTER LICENSES

SCOTT'S PUBLIC ADJUSTER LICENSES

Our Large Loss Specialties

Contact Us

LEGAL

Copyright 2026. ICRS LLC. All Rights Reserved.